Describe the Process Companies Use to Raise Equity Capital

Pre-seed funding refers to the initial capital a company brings in that comes from friends family members credit cards-whatever you can get. When the public buys some of the companys stock the company loses some equity but gains cash to fund its operations.

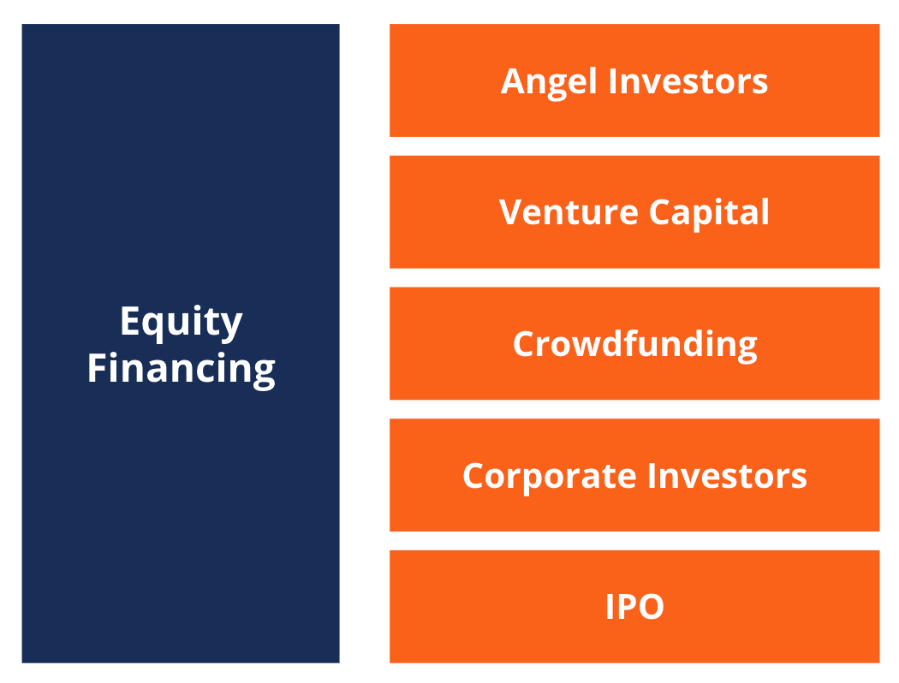

Equity Financing Overview Sources Pros And Cons

Persistence - the willingness to learn from rejection without losing enthusiasm -.

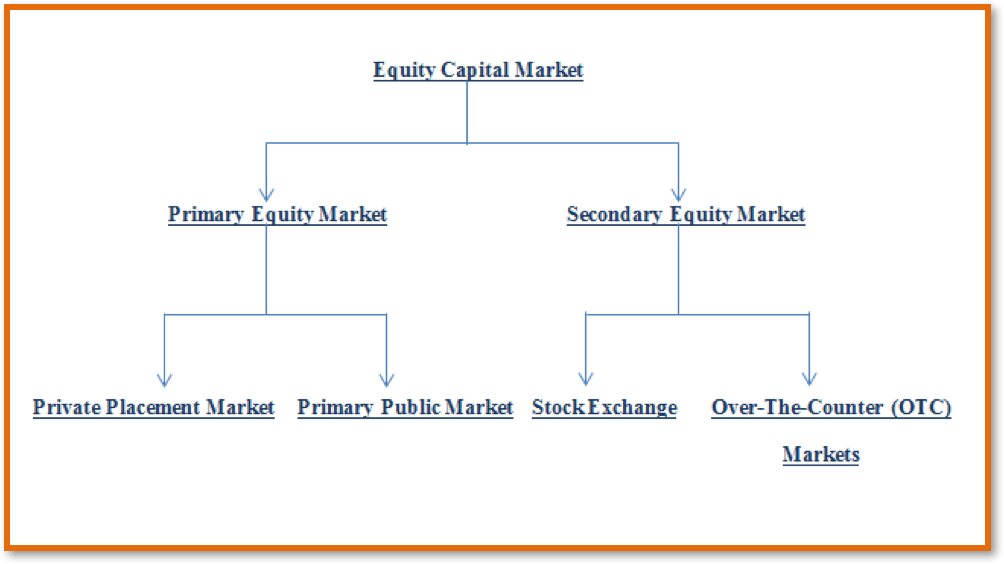

. Structure of the Equity Capital Market. It is further divided into two parts. Equity Financing Meaning Example Types Of Equity Financing Venture Capital Raising Capital Business Money Investment Banking.

Raising Funds for Equity is Governed by Federal and State Securities Law. Capital Raising Process Understand How Capital Raising Works. Describe the Process Companies Use to Raise Equity Capital Get link.

One way to raise capital for your privately held. In private placements the stock to be issued are directly sold to some specified investors. This is comparatively a low-cost method of raising equity capital as the flotation cost is minimal.

The private placement market allows companies to raise private equity through unquoted shares. Here are the five main stages of equity capital. Because the investor owns a portion of the business he or she takes a share of the profits and you dont have to pay interest on a loan.

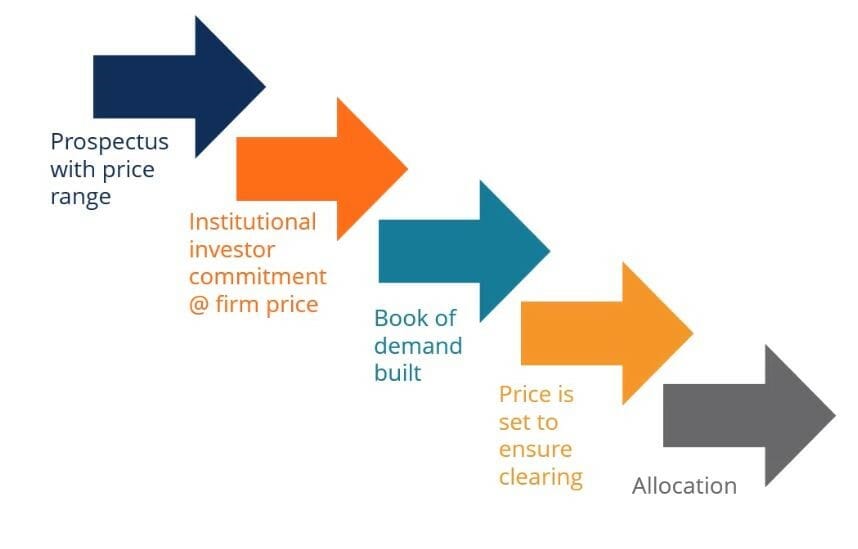

Mechanics of the equity raising process. An IPO raises a firms public profile making it easier to attract high-quality customers alliance partners and employees. An investor loans money to the company with the ability to convert the loan to an equity investment on the same or better terms than the next formal fundraising round.

Publicly held companies often generate capital by selling stock. In comparison public companies are publicly held with their shares being sold on the market to the public. When a company requires money to finance the start-up which has huge capital requirements with a robust business plan and has the potential to grow into a highly profitable venture the.

There are certain advantages to choosing equity capital over debt capital one of which is its ease of acquisition. 3An IPO is a liquidity event that provides a means for a company shareholders including its investors to cash out their investments. The capital issue is sold directly to a.

For example the owner of Company ABC might need to. Equity capital differs in the sense that it does not require the business owner to take on debt. As companies grow and shift their needs change.

Other Apps -. You can also entice potential stockholders to invest by communicating a quantification of stock appreciation potential. Common stock is the single most important source of capital for most new companies.

The equity capital market can be divided into two parts. Methods of raising equity capital include seeking out high worth individuals or firms with deep pockets to purchase stock. For Federal law Regulation D of the Securities Act of 1933 is a federal law that requires you to register any offering with the.

In a corporation owners equity mostly consists of stock or shares they own in their company which they hope will provide them with a return on their investment. Allows companies to raise capital from the market for the first time. Methods of Raising Equity Capital and Accessing Private Capital Markets.

Convertible debt is a hybrid debt and equity instrument that allows for companies to raise capital between formal fundraising rounds without having to establish a pre-money valuation of the company. An infusion of capital can be used for building a new facility introducing a new product line acquiring a. Many financing professionals claim that the rigorous stressful process of raising capital for a new venture ensures that only the best companies ie those most like to succeed receive funding.

In this situation you can instead try to raise equity capital. You raise equity capital by selling a share of your business to an investor. Is a way to raise equity capital to fund current and future operations.

Equity financing involves selling a portion of a companys equity in return for capital. As a way to raise capital via equity companies look for equity partners. In capital market rights issue means selling securities in primary market by issuing shares to existing shareholders.

The cost of raising funds through public issue is high as compared to other methods. If you are offering to sell a security such as the sale of stock of your corporation or membership units of your LLC you must comply with Federal and State securities law. The best way is to raise capital via equity through a company which works on almost the same lines and businesses as your company.

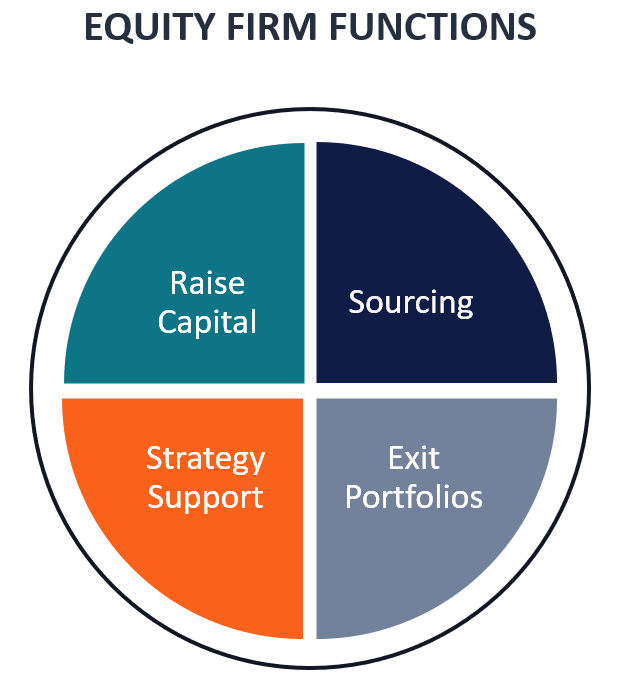

Companies prefer to raise capital via equity through private equity to avoid the stress involved in dealing a public holding company. Sometimes this creates the necessity to raise additional capital to fund an upcoming expansion or transition. Raising equity capital however often involves a loss of control.

The equity raising process. Instead investors buy partial ownership equity in the business without requiring the business owner to repay the funds. A firm can raise capital through private placement as well as public offering.

Raising equity capital must follow a process that has extensive procedural requirements and legal obligations. In order to raise funds to survive and grow a profitable venture for a longer period start-up companies make use of various methods namely. Pg 499 read along with rest of.

A Grant Thornton research study of 162 middle-market private. This could be as small as 5000 and as high as 100000. Critical to the success of private equity firms is their ability to raise capital.

To explain the process I divided the subject for convenience into four Parts across four webpages. Background to the equity raising process.

Capital Raising Process Understand How Capital Raising Works

No comments for "Describe the Process Companies Use to Raise Equity Capital"

Post a Comment